Germany’s Auto Industry at a Crossroads in 2025

In yet chaotic 2025, Germany’s automotive industry— in long time a symbol of engineering excellence and economic might—is navigating one of the most transformative and turbulent chapters in its history. Once the undisputed leader in global car manufacturing, German automakers now find themselves grappling with a confluence of economic recession, technological disruption, and geopolitical headwinds. The question is no longer whether change is coming, but whether Germany can lead it.

A Legacy Under Pressure

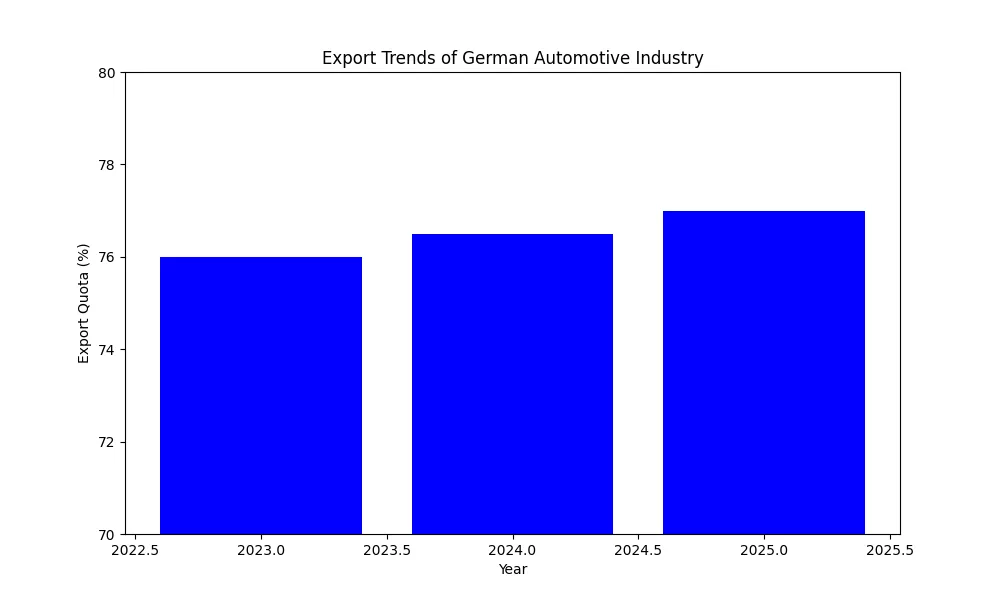

For decades, brands like Volkswagen, BMW, and Mercedes-Benz have defined the global standard for quality, performance, and innovation. But the very foundations of this legacy are being shaken. Germany’s economy remains in recession, and the auto sector—contributing roughly 6% to GDP and employing over 780,000 people—is both a victim and a vector of this downturn.

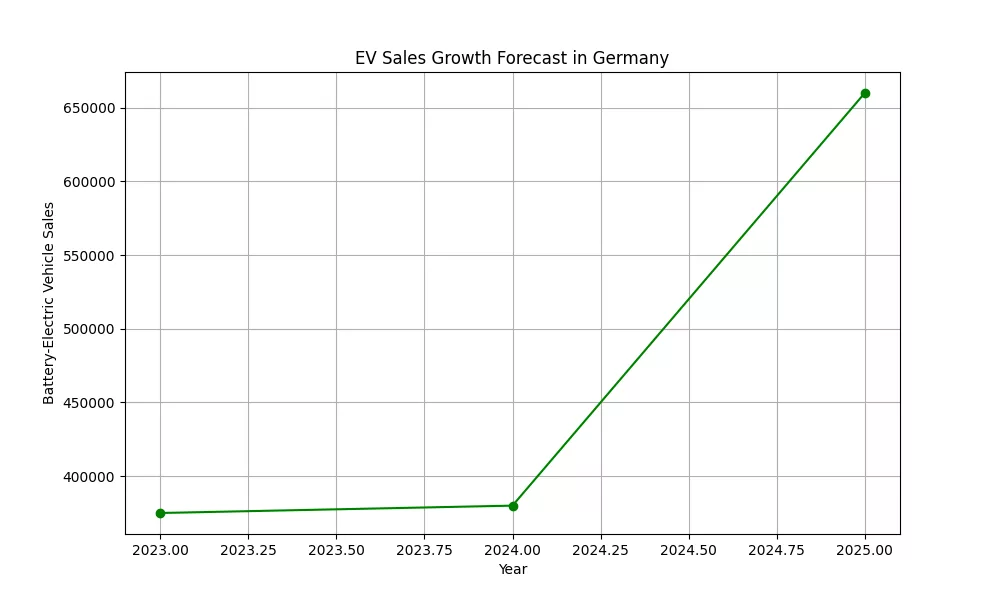

The abrupt withdrawal of EV subsidies in late 2023 sent shockwaves through the market, stalling momentum just as consumer interest was beginning to peak. Sales of battery-electric vehicles (BEVs) dropped sharply, and confidence in the government’s commitment to the energy transition wavered. Yet forecasts for 2025 suggest a rebound, with BEV sales expected to surge by 75%, signaling that the appetite for electrification remains strong—if fragile.

Losing Ground Abroad

Perhaps more concerning is Germany’s waning influence in key international markets. In China, the world’s largest auto market, domestic brands have outpaced German manufacturers in EV innovation, pricing, and digital integration. The rise of companies like BYD and NIO has exposed a critical vulnerability: Germany’s lag in software and battery technology.

This isn’t just a matter of competition—it’s a matter of relevance. As mobility becomes increasingly defined by connectivity, autonomy, and sustainability, traditional strengths in mechanical engineering are no longer sufficient. German automakers must evolve from car builders to tech companies, or risk obsolescence.

Opportunities in the Ashes

Despite the challenges, the industry is not without hope. Germany remains the second-largest EV producer globally, and domestic production is expected to grow by 30% in 2025. Solid-state battery development, long considered a holy grail of EV technology, is gaining traction in research labs across the country.

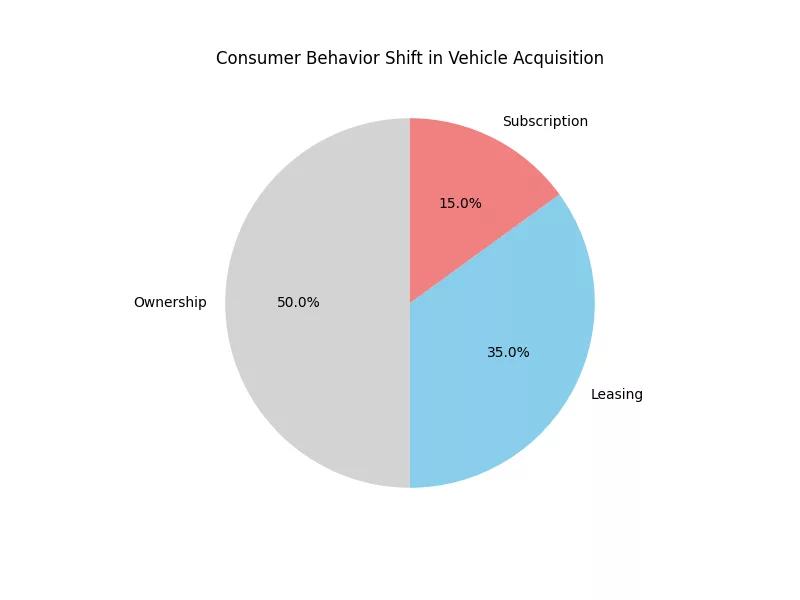

Moreover, the shift in consumer behavior—from ownership to leasing and subscription models—offers a new frontier for innovation. German firms are well-positioned to capitalize on this trend, provided they can adapt their business models and digital infrastructure accordingly.

A Strategic Imperative

To survive and thrive, German automakers must embrace a multi-pronged strategy:

– Accelerate EV and battery innovation, not just in hardware but in software ecosystems.

– Streamline production and reduce costs, learning from the agility of APAC competitors.

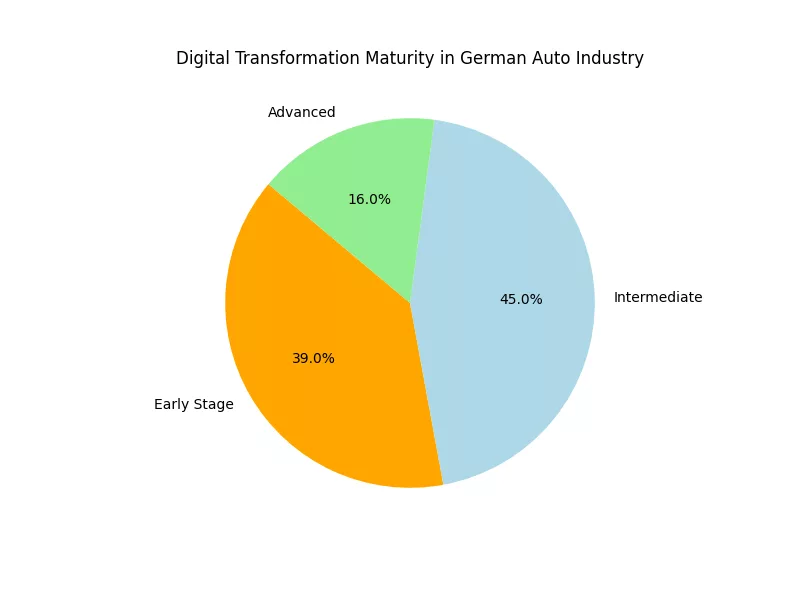

– Invest in digital transformation, from AI-driven manufacturing to connected car platforms.

– Push for stable and supportive policy frameworks, ensuring long-term clarity for consumers and investors.

– Expand into emerging markets, where demand for affordable, sustainable mobility is rising.

Reinventing the Wheel

Germany’s auto industry stands at a crossroads. The road behind is paved with success, but the road ahead demands reinvention. This is not merely a technological shift—it is a cultural one. It requires humanity, agility, and vision.

If Germany can harness its legacy while embracing the future, it may yet redefine what it means to lead in mobility. But time is of the essence, and the world is not waiting.