-

Global Responses to U.S. Government’s Stake in Intel

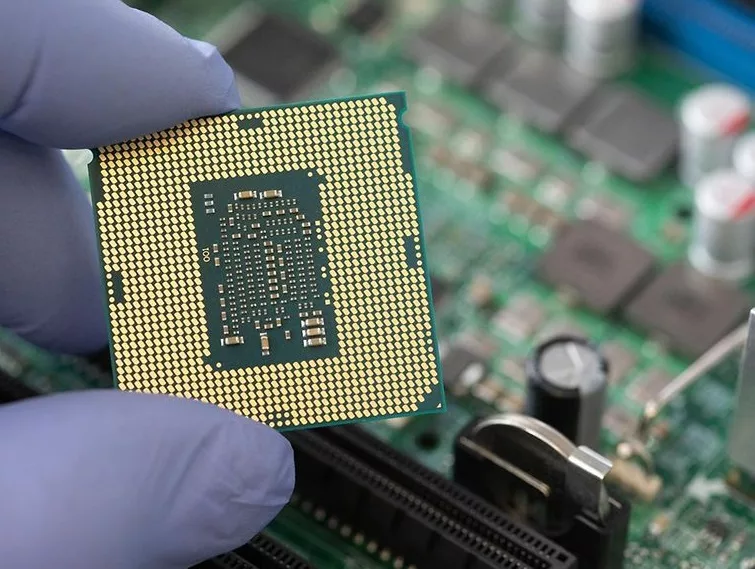

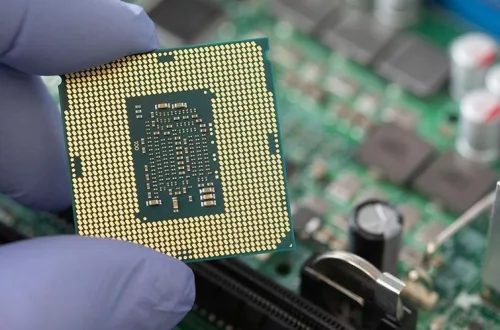

In a landmark move that reshapes the global semiconductor landscape, the United States government has acquired a 9.9% stake in Intel Corporation through an $8.9 billion investment. This decision, framed as a national security measure and a strategic effort to revitalize domestic chip manufacturing, has sparked a wave of reactions across the globe. While the deal is poised to strengthen Intel’s financial position and bolster U.S. technological sovereignty, it also raises concerns about market distortion, geopolitical tensions, and the future of international cooperation in the semiconductor industry.

The Negative Impacts of the Deal

1. Geopolitical Tensions and Tech Decoupling

The U.S. government’s direct control over Intel is widely interpreted as a signal of escalating tech nationalism. By backing a domestic chipmaker, Washington is reinforcing its stance against reliance on foreign semiconductor supply chains. This move is likely to deepen the technological divide between the U.S. and China, accelerating the decoupling of global tech ecosystems.

China, already investing heavily in its own semiconductor capabilities, may view this as a provocation, prompting retaliatory measures same as what the U.S. government kept doing to Chinese technology companies in the past years. The result could be a fragmented global market, where innovation is stifled by political boundaries.

2. Market Distortion and Competitive Imbalance

Intel’s newfound backing from the U.S. government introduces a significant distortion in the competitive landscape. Rivals such as TSMC and Samsung operate without direct equity support from their governments, relying instead on market forces and strategic partnerships.

The infusion of $8.9 billion into Intel, coupled with additional CHIPS Act funding, gives the company a financial cushion that could allow it to undercut competitors, secure exclusive contracts, and dominate emerging markets like AI chips and advanced foundry services. This raises questions about fair competition and may prompt other nations to consider similar interventions, potentially triggering a global subsidy race.

3. Investor Uncertainty and Governance Concerns

While the U.S. government has pledged to remain a passive investor, concerns persist about the potential for political interference in Intel’s strategic decisions. Investors fear that national security priorities could override shareholder interests, leading to decisions that prioritize geopolitical goals over profitability and innovation.

The philosophy is very basic. Today I can easily take over 10% of what you already have, tomorrow I can easily take over whatever you still have.

Moreover, the presence of a government stakeholder—even without board representation—could complicate Intel’s international partnerships, particularly in regions wary of data security and privacy. This uncertainty may dampen investor confidence and affect Intel’s valuation in the long term.

4. Supply Chain Disruption and Realignment

Intel’s pivot toward U.S.-based manufacturing, encouraged by federal support, could disrupt existing supply chains that span Europe and Asia. Countries that have invested in Intel’s expansion—such as Germany and Poland—are now facing project cancellations or delays, raising concerns about the reliability of U.S. corporate commitments.

This shift may force international partners to seek alternative suppliers or invest in domestic capabilities, leading to a more fragmented and less efficient global supply chain. The long-term consequences could include increased costs, reduced innovation, and slower time-to-market for advanced technologies.

5. Trade Implications and WTO Challenges

The deal may also face scrutiny under World Trade Organization (WTO) rules, which prohibit certain forms of state aid that distort international competition. If challenged, the U.S. could face diplomatic backlash or trade penalties, further complicating its relationships with allies and trading partners.

Additionally, the move could hinder ongoing trade negotiations, particularly with regions like the European Union that prioritize market fairness and regulatory transparency.

International Response

European Union: Strategic Autonomy and Disappointment

The European Union has responded to the Intel deal with a mix of strategic recalibration and frustration. The cancellation of Intel’s planned manufacturing sites in Germany and Poland has sparked criticism from European leaders, who view the shift as a betrayal of earlier commitments.

In response, the EU is accelerating its own semiconductor strategy under the European Chips Act, aiming to reduce dependence on U.S. and Asian suppliers. This includes increased funding for European firms, incentives for domestic R&D, and efforts to attract global talent.

However, the sudden withdrawal of Intel from key European projects has raised concerns about the reliability of foreign investment and the need for stronger industrial policy within the EU.

South Korea: Competitive Pressure and Policy Alarm

South Korea, home to semiconductor giants Samsung and SK Hynix, views the U.S. move as a direct challenge to its global leadership in chip manufacturing. Analysts warn that Intel’s government-backed resurgence could divert contracts from Korean firms, particularly in the foundry and AI chip sectors.

The deal has been criticized as protectionist, with experts calling for a reassessment of South Korea’s own industrial strategy. This may include increased subsidies, tighter export controls, and efforts to diversify partnerships beyond the U.S.

South Korean firms are also exploring deeper collaboration with European and Southeast Asian partners to mitigate the risks of U.S.-centric supply chains.

Southeast Asia: Opportunity and Caution

In Southeast Asia, the Intel deal is seen as both a challenge and an opportunity. Countries like Malaysia, Vietnam, and India are positioning themselves as alternative hubs for semiconductor manufacturing, capitalizing on the U.S.-China tech rivalry.

Intel’s $7 billion investment in Malaysia is viewed as a positive signal, but regional leaders remain cautious. Infrastructure gaps, regulatory instability, and talent shortages could limit the region’s ability to absorb advanced manufacturing and compete with established players.

Nevertheless, Southeast Asia is emerging as a key player in the global semiconductor realignment, offering a neutral ground for collaboration and innovation.

Conclusion

The U.S. government’s stake in Intel marks a turning point in global semiconductor policy. While it strengthens domestic capabilities and addresses national security concerns, it also introduces significant risks: market distortion, geopolitical tension, investor uncertainty, and supply chain fragmentation. The international response—from strategic recalibration in Europe to competitive alarm in Asia—reflects the complexity of the global semiconductor ecosystem. As nations grapple with the implications of this deal, the future of chip manufacturing will likely be shaped by a delicate balance between cooperation and competition, innovation and regulation, sovereignty and globalization.

-

Would Intel be converted into state-controlled enterprise?

The U.S. government is actively discussing converting up to $10.9 billion in CHIPS Act grants into Intel equity, which would give it a 10% stake and make it Intel’s largest shareholder. This move is not yet finalized, but negotiations are advanced, and Intel CEO Lip-Bu Tan has met with President Trump to discuss the deal.

The equity would come from restructuring milestone-based grants into direct ownership, giving the government voting power and long-term influence over Intel’s strategic direction. The U.S. may also target Intel Foundry specifically, which has been spun off as a semi-independent unit within Intel, to focus on leading-edge manufacturing.

Current Development

Intel stock initially rose nearly 15% on the news but has since shown volatility, reflecting investor uncertainty about the implications of government ownership. SoftBank has also invested $2 billion for a 2% stake, signaling private sector confidence in Intel’s turnaround.

This move is part of a broader trend of governments taking direct equity stakes in strategic tech sectors, similar to the Pentagon’s investment in MP Materials. It reflects a shift from subsidies to ownership, allowing the U.S. to shape Intel’s direction, especially in areas like AI, defense, and advanced chip manufacturing.

Legal and accounting questions remain, as CHIPS Act grants were originally designed as reimbursements, not equity. The final structure, valuation, and governance terms are still being negotiated, and no official confirmation has been issued by Intel or the White House.

Strategic Rationale

Intel is the only U.S.-headquartered advanced chipmaker capable of competing at leading-edge nodes (2nm and below). The investment is seen as a way to secure domestic chip production, reduce reliance on east Asia, and counter China’s tech rise.

Pros of Government Stake

National Security: Ensures U.S. control over critical infrastructure and chip supply chains.

Financial Stability: Provides Intel with long-term capital to fund fabs and R&D.

Industrial Policy Shift: Signals a move from subsidies to equity partnerships, reshaping tech investment norms.

Investor Confidence: May attract risk-averse investors seeking ‘safe’ tech plays backed by government.

Cons and Risks

Operational Constraints: Government ownership could limit Intel’s flexibility in global markets.

Geopolitical Tensions: Foreign nations may view Intel as a quasi-state entity, raising concerns over data security and neutrality.

Innovation Risk: Political mandates may interfere with R&D priorities or international collaborations.

Execution Risk: Unrealistic timelines or bureaucratic delays could hinder fab development.

Foreign Reactions and Concerns

China is likely to view Intel as a strategic U.S. asset, potentially restricting its market access, in the same philosophy that U.S. sees and treats Chinese firms. EU and Asian countries may reassess partnerships with Intel, fearing U.S. influence over technology, data security and supply chains. Global investors could recalibrate valuations based on geopolitical utility rather than traditional financial metrics.

Impact on Intel’s Future Business

Intel may become a ‘national champion’, prioritizing U.S. strategic goals over global competitiveness. Its foundry ambitions could be boosted by government contracts, especially in defense. However, Intel still lags behind in advanced node execution and faces stiff competition from TSMC and NVIDIA.

A New Tech Paradigm

The U.S. government’s stake in Intel marks a paradigm shift in how nations treat technology—as a strategic asset, not just a commercial product. This could lead to a bifurcation in the semiconductor industry: state-backed giants like Intel, aligned with national goals, and agile private firms like NVIDIA and AMD, focused on innovation and global markets. Intel’s future will depend on how well it balances government oversight with market competitiveness.